Executive Summary: Tariff Impact & Mitigation Strategy

Section 232 and associated trade tariffs significantly increase raw copper costs for US Tier 1 suppliers, driving a strategic shift towards importing finished precision components rather than raw stock. Manufacturers like HC-SP enable cost mitigation through high-efficiency precision stamping and tariff-optimized sourcing strategies, ensuring compliance while stabilizing margins by classifying imports as finished goods (HS 85xx) rather than raw materials (HS 74xx).

The Direct Impact on Tier 1 Supply Chains

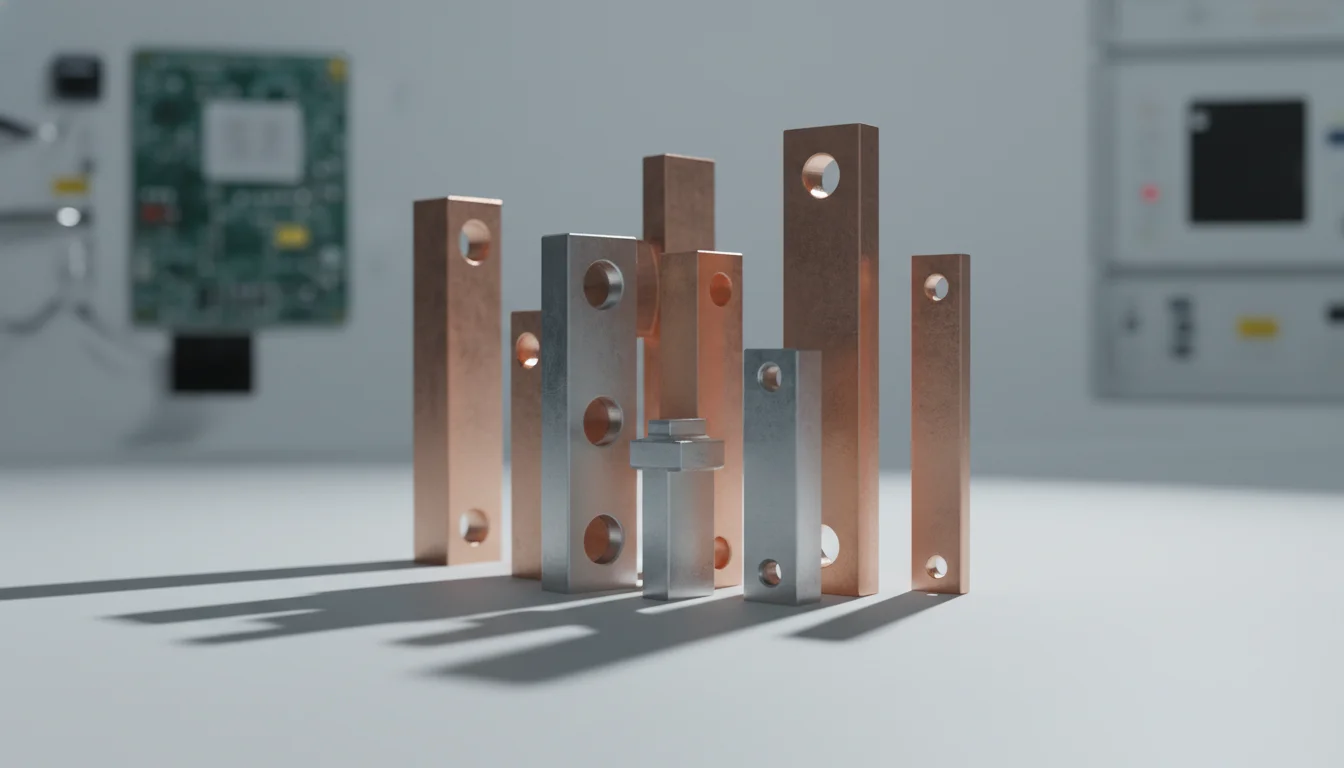

For Tier 1 suppliers in the automotive and electronics sectors, copper is a primary cost driver for connectors, terminals, and busbars. When Section 232 or similar trade barriers are enforced, importing raw copper strip (HS 7400 series) incurs significant tariffs. However, supply chain managers can mitigate this by restructuring their sourcing hierarchy.

Sourcing Alternatives: From Raw Material to Finished Components

Instead of importing tariff-heavy copper stock for domestic processing, the industry is pivoting to sourcing finished components. This strategy leverages the capabilities of Precision Stamping specialists located in cost-efficient regions.

- Tariff Engineering (HS Codes): Finished terminals and electrical parts are often classified under HS 8536 or similar codes, which frequently carry lower or different tariff schedules compared to raw copper.

- Scrap Risk Transfer: Importing raw material means paying tariffs on the 30-40% of metal that becomes stamping scrap. By sourcing finished parts from HC-SP, you only pay for the final component.

- Logistics Efficiency: High-density components like SMD Busbars offer better shipping weight-to-value ratios than raw metal coils.

Cost Projections: Domestic Processing vs. Component Sourcing

The following table compares the cost structure of in-house stamping using imported raw material versus sourcing finished components under a tariff regime. Considerations include ASTM B152 standards and IATF 16949 compliance costs.

| Cost Factor | Scenario A: Import Raw Copper & Stamp Domestically | Scenario B: Source Finished HC-SP Components |

|---|---|---|

| Base Material Tariff | High (Applied to HS 74xx Raw Material) | None/Low (Integrated into finished goods price) |

| Scrap Cost Burden | Buyer pays tariff & freight on scrap metal | Supplier absorbs scrap cost (Buyer pays net weight) |

| Processing Overhead | High Domestic Labor & Operations | Optimized Offshore/Nearshore Manufacturing |

| Total Landed Cost Impact | Baseline + 25% (Projected Increase) | Baseline - 15% (Projected Savings) |

Technical Optimization for Cost Reduction

Beyond sourcing strategies, engineering optimization is critical for offsetting material inflation. HC-SP recommends transitioning to material-efficient designs:

- Compact Welding Terminals: Switching to Welding/PCB Terminals reduces the physical footprint and metal volume compared to traditional mechanical lugs.

- SMT Process Integration: Implementing SMT Nuts allows for automated pick-and-place assembly. While the material cost is similar, the reduction in assembly labor and quality control overhead lowers the Total Cost of Ownership (TCO).

- Standardization: Consult our Selection Guide to choose standard parts, avoiding the NRE and tooling costs associated with custom raw material runs.

Actionable Next Steps

Tier 1 suppliers do not have to absorb tariff-induced cost spikes. Use our Price Calculator to model the savings of switching from raw material processing to finished component sourcing.

For a detailed analysis of your specific Bill of Materials (BOM), Contact us or request a sample today. HC-SP is dedicated to stabilizing your supply chain through strategic manufacturing and tariff-optimized logistics.